Most people know they should invest, but they don’t—either because they think they need a lot of money, they’re scared of losing it, or they don’t know where to start. The truth? Investing isn’t just for the rich, and waiting will cost you more than making mistakes.

If you’ve never invested before or you’ve been putting it off, this guide will show you how to start investing the smart way—even if you have no experience. These investing strategies for beginners will help you build wealth, avoid common traps, and grow your money over time.

1. Start early (because time matters more than money)

One of the most overlooked investing strategies for beginners is understanding that time is more valuable than the amount you invest. Many people wait until they have “enough” money to start investing, but the longer you wait, the harder it becomes to build significant wealth.

The reason? Compound interest.

How compound interest works:

- If you invest $200 a month starting at age 25, at an 8% annual return, by age 60, you’ll have $622,000.

- If you wait until age 35 to start? You’ll have just $274,000—less than half.

Waiting just 10 years costs you nearly $350,000.

How to do it:

✅ Start now, even if it’s just $50 a month.

✅ Use compound interest to your advantage—the earlier you start, the less you have to invest.

✅ Don’t wait until you “know everything”—learning while investing is better than doing nothing.

💡 Your money needs time to grow. Every year you wait is money lost.

2. Choose the right investment platform

One of the most important investing strategies for beginners is choosing a platform that makes investing simple, low-cost, and accessible.

There are plenty of investment platforms available, but not all are beginner-friendly. Here are some of the best options:

Best platforms for beginners:

- eToro – Great for beginners who want to invest in stocks, ETFs, and even cryptocurrencies with zero commission fees. eToro also offers a copy trading feature, allowing you to automatically mirror the trades of successful investors. eToro is available in numerous countries, including the UK, Australia, and many European nations. However, it’s not accessible in certain regions like the USA. Here’s a full list of countries where eToro is supported.

- StashAway – A robo-advisory platform that automatically invests your money in a diversified portfolio based on your risk level. Ideal for beginners who want a hands-off, long-term investing approach. StashAway is available for Singapore, Malaysia, Hong Kong, Thailand, and the UAE customers.

- Revolut – A fintech app that allows easy trading of stocks, ETFs, and even cryptocurrencies with low fees. Best for beginners who want a simple way to invest through their banking app. Revolut’s investment features are currently being piloted in Greece, Denmark, Czechia, and Lithuania, with plans to expand to other European Economic Area countries.

- Robinhood (U.S. only) – A beginner-friendly platform for stock trading with no commission fees.

How to do it:

✅ If you want an easy way to start, eToro is a great choice. It’s user-friendly and lets you learn while investing.

✅ Look for platforms with low fees and easy navigation.

✅ Avoid platforms with hidden charges—fees can eat into your profits over time.

🔥 The right platform makes investing easier, so pick one that fits your needs.

Why eToro is the Best Platform for Beginner Investors

If you’re looking for a simple, secure, and commission-free way to start investing, eToro is the perfect choice. With over 30 million users worldwide, eToro is one of the most trusted and beginner-friendly investment platforms available.

Why Choose eToro?

✅ Zero-commission fees – Buy and sell stocks and ETFs with no hidden costs.

✅ Copy trading – Automatically mirror the trades of top investors and grow your portfolio like a pro.

✅ Diverse investment options – Trade stocks, ETFs, cryptocurrencies, and commodities all in one place.

✅ User-friendly interface – No complicated charts or jargon—just a clean, easy-to-use platform.

✅ Strong security & regulation – Fully licensed in multiple countries, ensuring your money is safe.

Whether you’re new to investing or looking for a hassle-free way to build wealth, eToro makes it easy. Join today and start investing in minutes!

3. Automate your investments (so you never miss a month)

One of the simplest yet most powerful investing strategies for beginners is automation. The biggest reason people fail at investing isn’t that they pick the wrong stocks—it’s that they don’t stay consistent.

Why automation works:

- Removes emotional decision-making (you invest even when the market is down).

- Ensures you never forget to invest.

- Builds wealth without requiring effort every month.

How to do it:

✅ Set up an automatic monthly transfer from your bank to your investment account.

✅ Use dollar-cost averaging (DCA)—investing a fixed amount each month, no matter what the market is doing.

✅ Avoid trying to “time the market”—investing regularly beats waiting for the “perfect” moment.

🔥 The best investors remove emotions from the process. Automation does that for you.

4. Focus on low-cost index funds (not individual stocks)

Many beginners think investing means picking individual stocks and trying to “beat the market.” But even professional investors struggle to consistently pick winners.

That’s why one of the most effective investing strategies for beginners is using index funds, which let you invest in a whole market rather than betting on one company.

Why index funds are great for beginners:

- Low risk compared to picking individual stocks.

- Diversified—you own hundreds of companies instead of one.

- Proven returns—S&P 500 index funds have averaged around 8-10% per year over decades.

How to do it:

✅ Invest in S&P 500 index funds (tracks the top 500 companies in the U.S.).

✅ Choose low-cost ETFs (like Vanguard’s VOO or BlackRock’s IVV) to minimise fees.

✅ Hold long-term—don’t panic over short-term market drops.

💡 Most stock pickers lose. Index fund investors quietly build wealth.

5. Diversify your portfolio (so one bad investment won’t wipe you out)

Putting all your money into one stock, cryptocurrency, or asset is gambling, not investing. A strong investing strategy for beginners is diversification—spreading your investments across different assets and geographies to reduce risk.

How diversification protects you:

- If one investment performs poorly, others balance it out.

- Protects you from market crashes in a single sector.

- Increases long-term stability and returns.

How to do it:

✅ Stocks (60-80%) – Low-cost index funds should be your core investment.

✅ Bonds (10-20%) – Lower risk, steady returns for balance.

✅ Real estate or REITs (5-15%) – Property investments or real estate funds.

✅ Cash or high-yield savings (5-10%) – For emergencies and short-term needs.

🔥 Diversification protects you. If one investment struggles, others will balance it out.

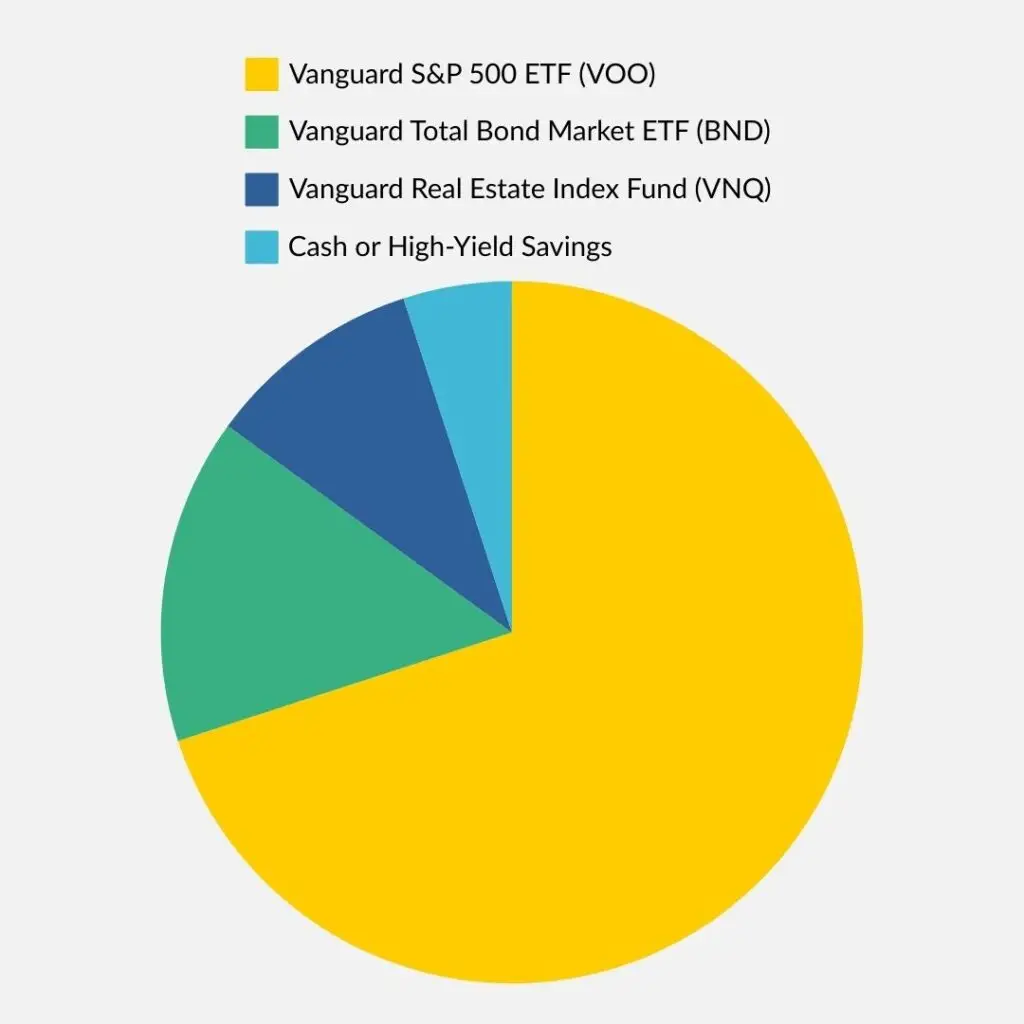

Building a diversified investment portfolio is essential for balancing potential growth with risk management. Based on the above specified allocation and a total investment of $1,000, here’s a proposed portfolio:

1. Stocks (70% or $700) — Vanguard S&P 500 ETF (VOO): This ETF offers exposure to 500 of the largest U.S. companies, providing broad market coverage.

2. Bonds (15% or $150) — Vanguard Total Bond Market ETF (BND): This fund encompasses a wide range of U.S. investment-grade bonds, offering diversification across various bond types.

3. Real Estate Investment Trusts (REITs) (10% or $100) — Vanguard Real Estate Index Fund (VNQ): This ETF invests in real estate investment trusts, giving exposure to the real estate sector without the need to own physical property.

4. Cash or High-Yield Savings (5% or $50) — Allocate this portion to a high-yield savings account or a money market fund to ensure liquidity for emergencies or short-term needs.

Historical performance overview: Historically, a portfolio with a 70% allocation to stocks and 30% to bonds has demonstrated robust performance. Over the past decade, such a portfolio has achieved an average annual return of approximately 9.76%, with an 8.45% standard deviation, indicating moderate volatility.

Disclaimer: This information is for educational purposes only and should not be construed as financial advice. Investment decisions should be based on your individual financial situation, risk tolerance, and investment objectives.

By adhering to this diversified approach, you position yourself to capitalise on market growth while mitigating potential risks.

Final thoughts: Investing is a long-term game

Investing isn’t about luck, timing the market, or picking the next big stock. It’s about starting early, being consistent, and staying in the game.

Here’s the winning investing strategy for beginners:

✔ Start now—time is your biggest advantage.

✔ Pick a beginner-friendly platform like eToro, StashAway, or Revolut to make investing easy.

✔ Automate your investments so you never miss a month.

✔ Focus on index funds and low-cost ETFs.

✔ Diversify—don’t put all your money into one thing.

✔ Reinvest your dividends to accelerate growth.

✔ Keep learning and increasing your investments over time.

Most people will never build wealth because they never start. Don’t be most people.

The best time to start investing was 10 years ago.

The second-best time? Today. 🚀

Build Wealth on Autopilot: How to Invest Smart & Grow Your Money Effortlessly

🚀 Build Wealth on Autopilot is the no-stress investing guide for busy professionals who want to grow their money without wasting hours on research, complicated strategies, or financial jargon.

Get your copy! 👉